Donate

As a non-profit organization, Oakland Ballet Company looks to the community to help ensure we are keeping the art of dance exciting, vibrant, and accessible. Ticket revenue contributes only a fraction of the cost to produce a show. The rest comes from you!

By making a contribution to OBC, you will support the many exciting performances as well as our Discover Dance program that provides arts education for thousands of K-12 students each year. We have a variety of ways in which you can support Oakland Ballet – from one time or monthly donations to legacy donations that help ensure the future of Oakland Ballet.

Angel Island Project Fund

Click below to donate to the Angel Island Project Fund.

*Note: These totals are not included in the 60th Anniversary totals.

Donations via check will not display on the Zeffy site.

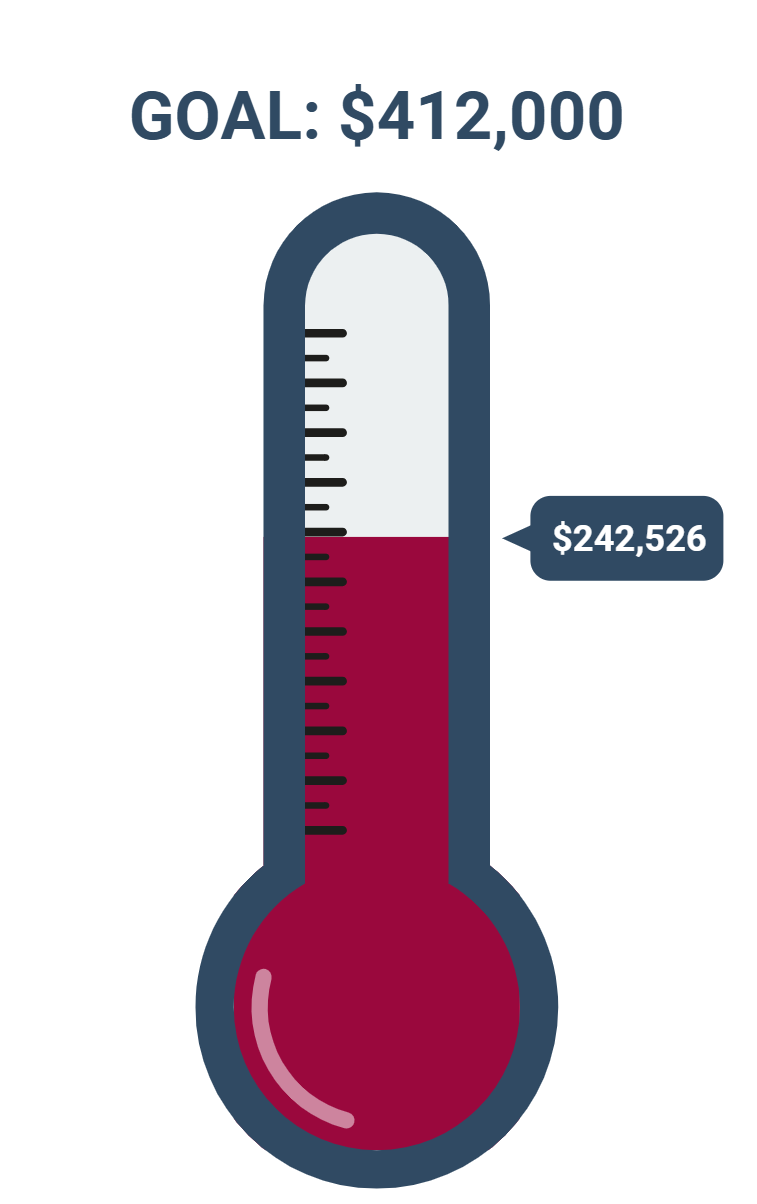

60TH ANNIVERSARY CAMPAIGN

Help us raise $360,000 for our 60th Anniversary!

*Note: Donations via check will not display on the Zeffy site.

GENERAL DONATIONS AND PLANNED GIVING OPTIONS

No matter how you choose to give, donations of every amount make a difference.

*Zeffy ensures 100% of your donation is given to OBC*

Email info@oaklandballet.org for information on how to donate stock, bonds or mutual funds.

Check with your financial institution and recommend Oakland Ballet Company to receive charitable funds.

ESTABLISH A LASTING LEGACY AT OAKLAND BALLET

- Gifting Appreciated Securities

Whether for a general contribution or to support a specific program, you can donate your appreciated security (stock, mutual fund, etc.) for this purpose. - Gifting Proceeds From An Inheritance/The Sale Of An Asset

Many people choose to make an additional gift to Oakland Ballet when they receive an inheritance or at the time of the sale of a home or business. These one-time gifts make a huge impact on our annual operations and can be designated toward general support, a specific project, or an endowment. - Making A Bequest

In as little as one sentence, you can leave money to Oakland Ballet in your will or living trust.* This type of legacy gift supports OBC for years to come. If you have already made a provision for OBC in your estate plan, please let us know so that we may properly thank and recognize you. Even if you prefer not to be recognized, knowing about your gift helps us plan for the future and maximize the impact of your generosity. - Designating Oakland Ballet As A Beneficiary

You can also designate OBC as the beneficiary of your IRA or Retirement Plan, Life Insurance Policy, or Commercial Annuity. This gift lasts beyond your lifetime and helps sustain OBC for future generations. - Gifting From Your IRA Through A Qualified Charitable Distribution (QCD)

You can give to Oakland Ballet each year from your IRA or other eligible account that requires a minimum annual distribution without having to pay income tax on the donation. This type of gift is commonly called an IRA charitable rollover or qualified charitable distribution (QCD).*

For more information contact us at info@oaklandballet.org.

ESTABLISH A LASTING LEGACY AT OAKLAND BALLET:

Click the image above for more information

Check with your employer to see if your donation is eligible for a company matching donation.